Top ESG Reporting Frameworks: Choosing the Right One for You

Defined by increasing stakeholder awareness and a growing imperative for sustainable business practices, Environmental, Social, and Governance (ESG) reporting has transitioned from a voluntary exercise to an essential component of corporate accountability and long-term value creation. Investors, customers, employees, and regulators are increasingly scrutinizing companies’ ESG performance, demanding transparency and comparability. This has led to a proliferation of ESG reporting frameworks, each with its own nuances, focus areas, and target audience. For businesses embarking on or refining their ESG reporting journey, understanding these frameworks and selecting the appropriate one is a critical strategic decision.

This blog post delves into the landscape of prominent ESG reporting frameworks, analyzing their key features, applicability, and the factors companies should consider when making this crucial choice. By navigating this complex terrain effectively, organizations can not only meet stakeholder expectations but also unlock the numerous benefits that robust ESG reporting can offer. Ranging from enhanced reputation and investor confidence to improved operational efficiency and risk management.

The Rise of ESG Reporting: A Response to Stakeholder Demands

The increasing emphasis on ESG reporting is driven by a confluence of factors. Investors are recognizing that ESG factors are material to financial performance and long-term sustainability.

Climate change, social inequality, and governance failures pose significant risks and opportunities for businesses. Integrating ESG considerations into investment decisions is no longer seen as solely ethical but also as a prudent financial strategy.

Consumers are also increasingly conscious of the social and environmental impact of the products and services they purchase. They are more likely to support companies with strong ESG credentials and may boycott those with poor track records.

Similarly, employees are drawn to organizations that align with their values and demonstrate a commitment to sustainability and ethical conduct.

Furthermore, regulators worldwide are introducing new rules and regulations mandating or encouraging ESG disclosure. This reflects a growing recognition of the systemic risks associated with environmental degradation, social unrest, and poor governance.

In this context, a well-defined and credible ESG report serves as a vital communication tool, allowing companies to demonstrate their commitment to sustainable practices, manage risks effectively, and build trust with stakeholders.

However, the sheer number of available frameworks can be overwhelming, making the selection process a significant undertaking.

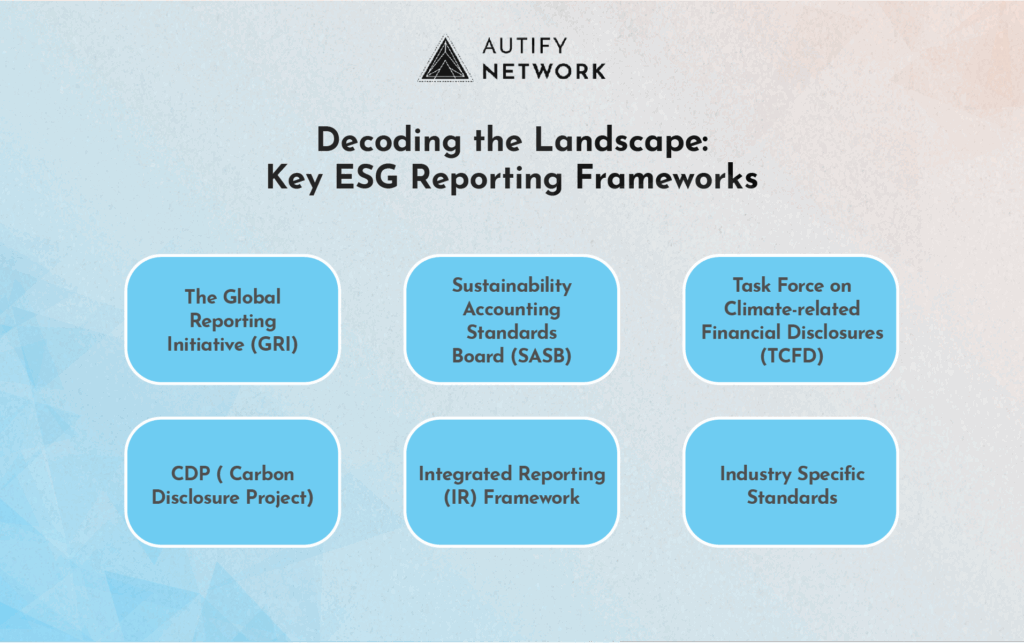

Decoding the Landscape: Key ESG Reporting Frameworks

Several prominent global and industry-specific frameworks have emerged as leading standards for ESG reporting. Understanding their distinct characteristics is crucial for informed decision-making.

1. The Global Reporting Initiative (GRI)

The Global Reporting Initiative (GRI) is a comprehensive sustainability reporting framework that covers a wide range of economic, environmental, and social topics. It uses a principles-based approach, allowing organizations flexibility in determining material topics based on their specific context and stakeholder concerns.

The GRI structure consists of universal standards applicable to all organizations, along with topic-specific standards that organizations select following a materiality assessment. Key features of GRI include an emphasis on materiality, stakeholder engagement, and transparency.

It is widely recognized and used globally across various industries, offering detailed guidance on reporting specific topics such as emissions, water usage, labor practices, and human rights.

GRI is suitable for organizations of all sizes and sectors seeking a comprehensive and globally recognized framework. Particularly useful for companies wanting to provide a broad picture of their sustainability performance and impact.

2. The Sustainability Accounting Standards Board (SASB)

The Sustainability Accounting Standards Board (SASB) focuses on industry-specific standards that address financially material sustainability topics affecting investor decisions. SASB’s approach is primarily investor-oriented, emphasizing the link between sustainability performance and financial outcomes.

The structure provides a set of disclosure topics and accounting metrics tailored to 77 specific industries. Its key features include a strong emphasis on financial materiality, comparability across companies within the same industry, and the provision of decision-useful information for investors.

SASB narrows its focus to ESG issues most relevant to financial performance in each sector. It is ideal for companies that want to tailor their ESG reporting to information most relevant to investors and demonstrate the financial implications of their sustainability efforts. Especially in sectors with significant environmental or social risks.

3. The Task Force on Climate-related Financial Disclosures (TCFD)

The Task Force on Climate-related Financial Disclosures (TCFD) is centered on climate-related risks and opportunities and their financial implications for organizations. It is structured around four core elements: Governance, Strategy, Risk Management, and Metrics and Targets.

TCFD provides recommendations for disclosing climate-related information across these pillars, helping organizations assess and communicate their climate-related risks and opportunities to investors and other stakeholders. The framework’s key features include a specific focus on climate change, an emphasis on scenario analysis and resilience planning, and the integration of climate-related risks into mainstream financial reporting.

TCFD is gaining increasing traction among investors and regulators globally and is essential for companies exposed to climate-related risks and opportunities, such as those in energy, transportation, agriculture, and finance.

4. CDP (formerly the Carbon Disclosure Project)

CDP is an environmental disclosure platform that primarily focuses on climate change, water security, and forests. It requests information from companies about their environmental impacts through annual questionnaires, which are aligned with TCFD recommendations.

CDP provides a standardized format for environmental data disclosure, enabling benchmarking against peers and driving corporate environmental action through investor and customer engagement.

Companies use CDP to disclose their environmental performance, particularly regarding carbon emissions, water usage, and deforestation impacts, to a wide range of stakeholders. CDP is widely used by investors to assess environmental risks and opportunities.

5. Integrated Reporting (IR) Framework

The Integrated Reporting (IR) Framework is designed to communicate how an organization’s strategy, governance, performance, and prospects, within the context of its external environment, lead to value creation over the short, medium, and long term.

The framework is principles-based and emphasizes the interconnectedness of different capitals, including financial, manufactured, intellectual, human, social and relationship, and natural. It is guided by eight content elements fundamental to an integrated report.

The IR Framework offers a holistic view of value creation, highlighting the interdependencies between various aspects of a business and aiming to provide a concise and connected narrative.

It is suitable for organizations seeking to present a more integrated and strategic view of their performance and value creation, clearly demonstrating the link between ESG factors and overall business strategy.

6. Industry-Specific Standards

In addition to these overarching frameworks, there are various industry-specific standards and initiatives that address the unique ESG risks and opportunities relevant to particular sectors.

Examples include the Global Real Estate Sustainability Benchmark (GRESB) for real estate and infrastructure companies, the Sustainability in Apparel Coalition (SAC) Higg Index for the apparel and footwear industry, and the Responsible Jewellery Council (RJC) Code of Practices for the jewelry industry.

Companies operating in specific sectors should explore these industry-specific standards to ensure their reporting aligns with best practices and addresses the most relevant issues for their stakeholders.

Choosing the Right Framework: A Step-by-Step Approach

Selecting the most appropriate ESG reporting framework is a critical decision that should be aligned with a company’s specific circumstances, goals, and stakeholder landscape. Here’s a step-by-step approach to guide this process:

Step 1: Understand Your Stakeholders and Their Information Needs

- Identify your key stakeholders: Investors, customers, employees, regulators, communities, NGOs, etc.

- Determine what ESG information is most relevant and material to each stakeholder group. What are their key concerns and priorities? What information do they need to make informed decisions?

- Consider any regulatory requirements or industry-specific expectations that may influence your reporting choices.

Step 2: Define Your Reporting Objectives and Scope

- What are your primary goals for ESG reporting? Is it to attract investors, enhance reputation, comply with regulations, improve operational efficiency, or engage stakeholders?

- Determine the scope of your reporting. Will it cover the entire organization, specific business units, or the value chain?

- Consider your current data collection capabilities and resources. Which frameworks are feasible to implement given your existing infrastructure?

Step 3: Assess the Materiality of ESG Topics

- Conduct a materiality assessment to identify the most significant ESG issues that impact your business and stakeholders. This process involves evaluating the significance of various ESG topics from both a financial and an impact perspective.

- Different frameworks place varying emphasis on materiality. SASB, for instance, has a strong focus on financial materiality for investors, while GRI takes a broader view encompassing impacts on the economy, environment, and people.

Step 4: Evaluate the Key Features and Applicability of Different Frameworks

- Compare the frameworks based on their focus, approach, structure, and key features, as outlined earlier in this blog post.

- Consider the industry-specific relevance of each framework. Is there a widely adopted standard in your sector?

- Assess the level of detail and rigor required by each framework. Does it align with your reporting ambitions and capabilities?

- Evaluate the level of stakeholder recognition and acceptance of each framework. Which frameworks are most influential among your key stakeholders?

Step 5: Consider Convergence and Interoperability

- Recognize that the ESG reporting landscape is evolving, with increasing efforts towards convergence and interoperability among different frameworks.

- The IFRS Foundation’s International Sustainability Standards Board (ISSB) is working to develop a comprehensive global baseline of sustainability disclosure standards for the capital markets, building upon the TCFD recommendations and incorporating elements from other frameworks.

- Consider how different frameworks can complement each other. For example, a company might use GRI for comprehensive reporting and SASB to provide financially material information to investors. Aligning with TCFD recommendations is increasingly important across various frameworks.

Step 6: Pilot and Iterate

- Once you have identified a potential framework (or a combination of frameworks), consider a pilot reporting exercise to assess its feasibility and identify any challenges.

- Gather feedback from internal stakeholders and potentially external stakeholders on your pilot report.

- Be prepared to iterate and refine your reporting approach as you gain experience and the ESG reporting landscape continues to evolve.

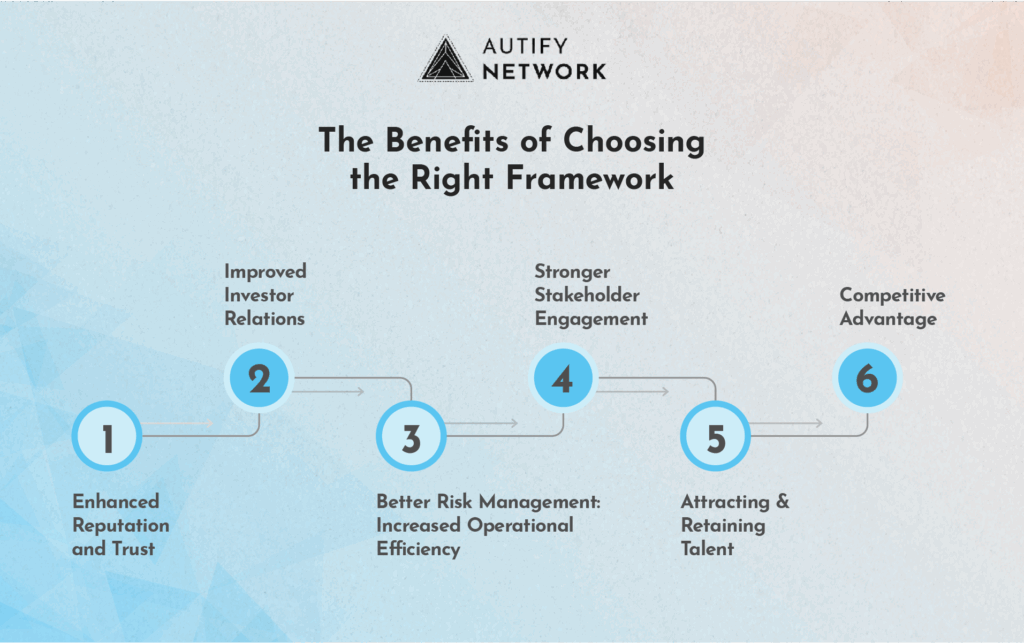

The Benefits of Choosing the Right Framework

Selecting and implementing the right ESG reporting framework can yield significant benefits for your organization. The benefits can include:

- Enhanced Reputation and Trust: Transparent and credible ESG reporting builds trust with stakeholders and enhances the company’s reputation.

- Improved Investor Relations: Providing investors with relevant and comparable ESG data can attract capital and lower the cost of financing.

- Better Risk Management: Identifying and disclosing ESG risks allows companies to proactively manage these risks and build resilience.

- Increased Operational Efficiency: Focusing on ESG factors can drive innovation and lead to cost savings through resource efficiency and waste reduction.

- Stronger Stakeholder Engagement: Reporting on issues that matter to stakeholders fosters better communication and collaboration.

- Attracting and Retaining Talent: Employees are increasingly drawn to companies with strong ESG commitments.

- Competitive Advantage: Robust ESG performance and transparent reporting can

- differentiate a company from its peers.

Conclusion

Choosing the right ESG reporting framework is not merely a compliance exercise. It is a strategic decision that can significantly impact a company’s long-term success. By carefully considering their stakeholders, objectives, materiality, and the nuances of different frameworks, organizations can select the approach that best aligns with their values, business model, and reporting goals.

As the ESG landscape continues to mature and converge, companies that embrace transparency and proactively engage in robust reporting will be better positioned to navigate the evolving expectations of stakeholders, manage risks effectively, and capitalize on the opportunities presented by the transition to a more sustainable and equitable economy. The journey towards effective ESG reporting is an ongoing one, requiring continuous learning, adaptation, and a commitment to transparency and accountability. By making informed choices about their reporting frameworks, companies can lay a strong foundation for a sustainable and prosperous future.